A scalable eCommerce platform with website and app solutions for single or multi-vendor businesses.

Launch Fast. Scale Smart. Sell Anywhere With Our Complete eCommerce Website & App Package

Ranging from individual retailers to full-fledged multi-vendor marketplaces

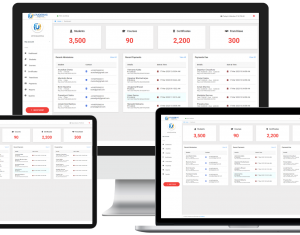

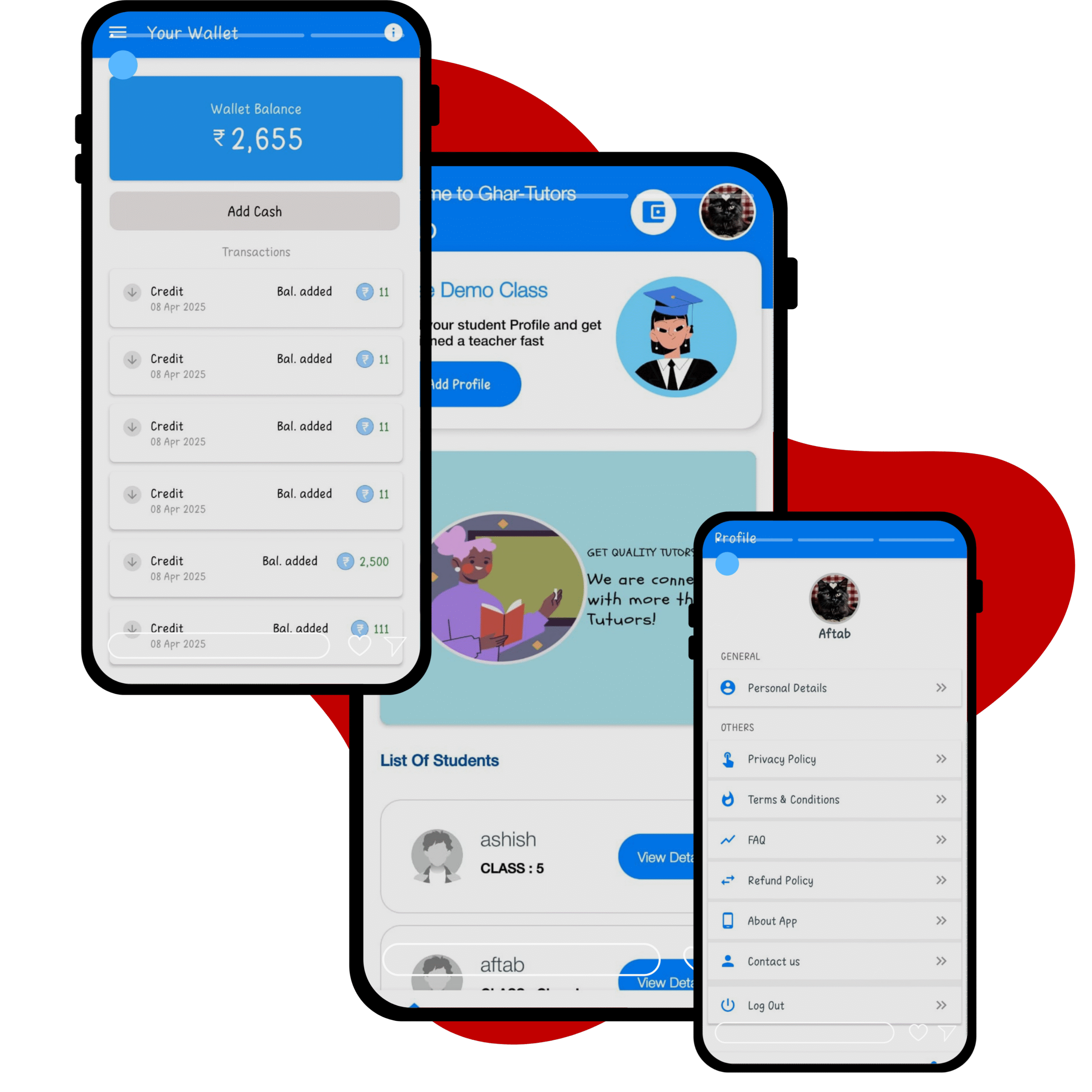

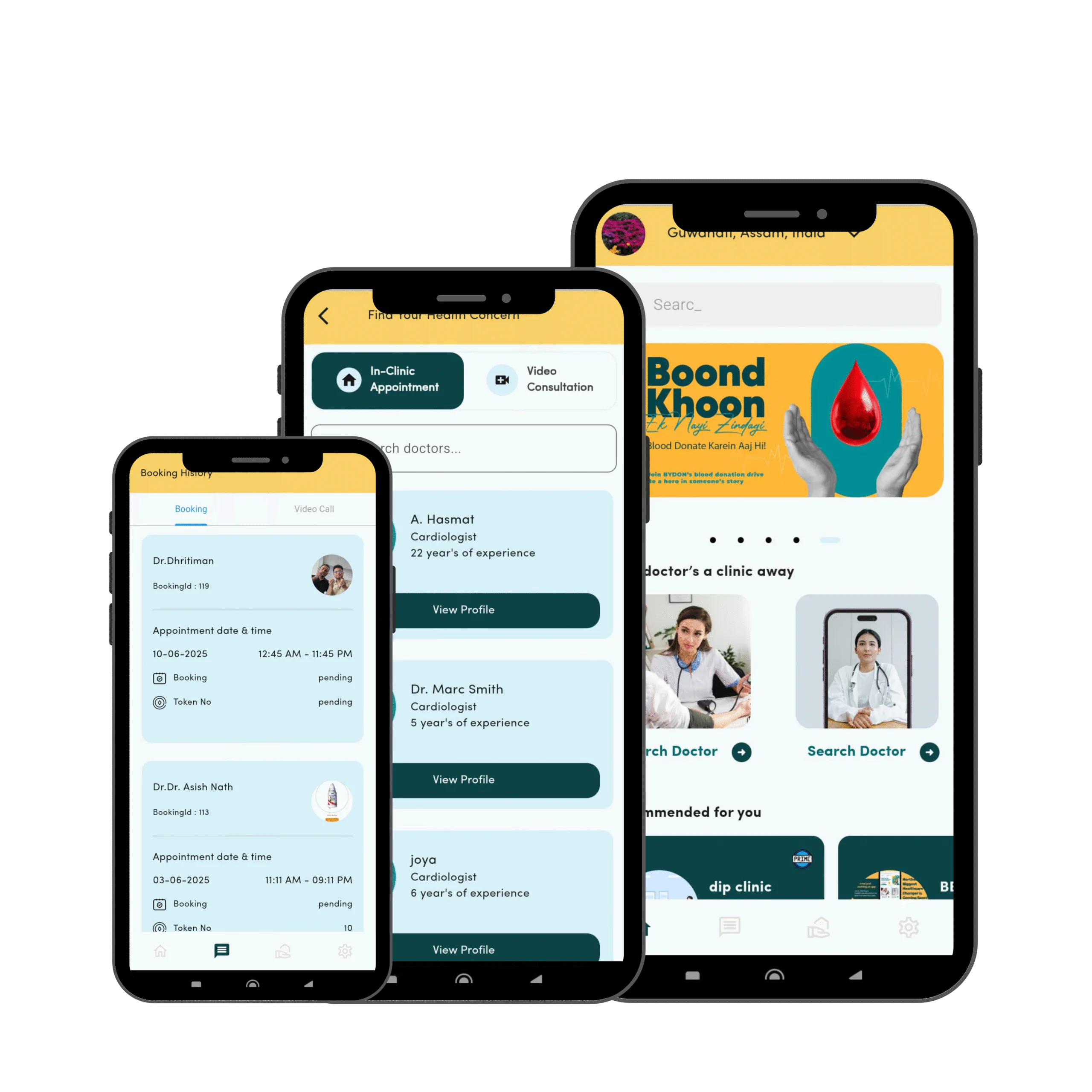

The platform includes both website and mobile applications

a consistent and modern user experience across devices.

Why an eCommerce Business Needs a Specialized eCommerce management System

A robust and scalable eCommerce platform offering complete website and mobile app solutions for businesses of all sizes—ideal for both single and multi-vendor models.

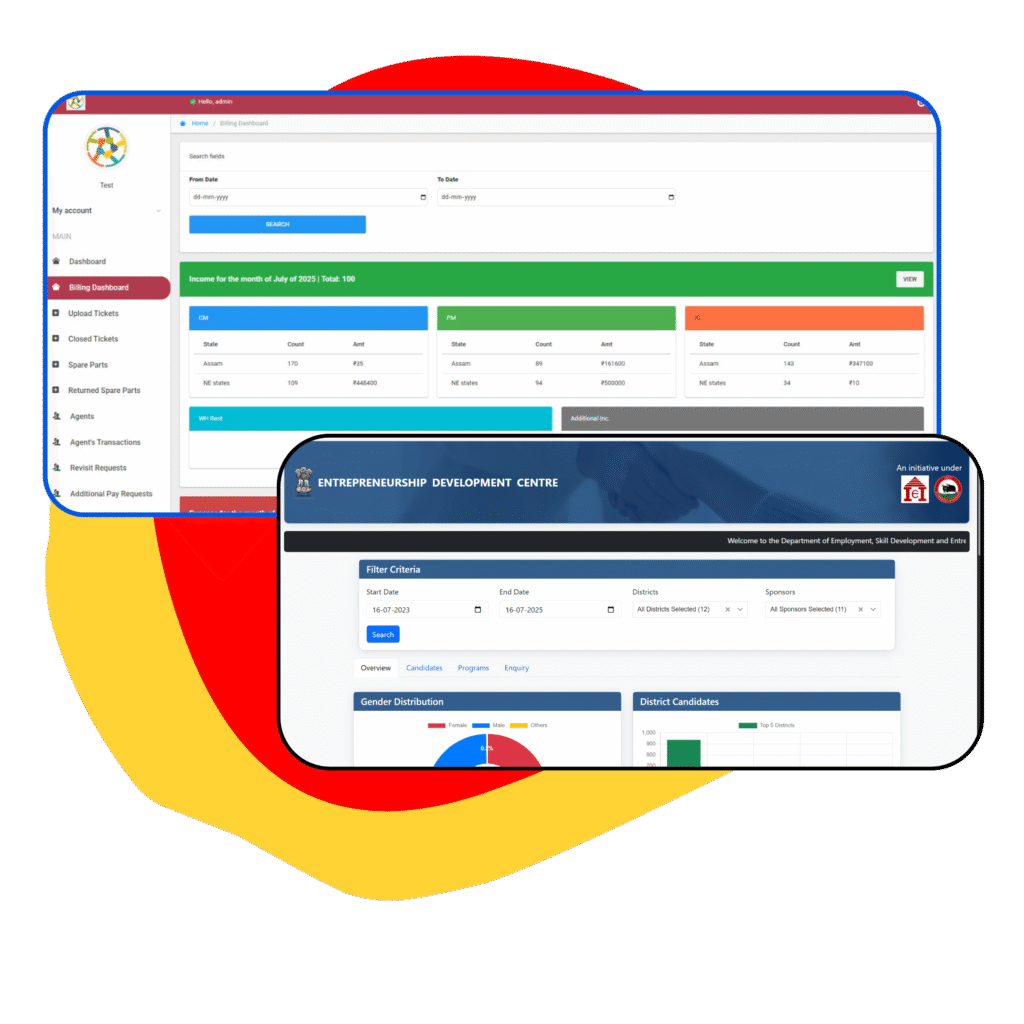

Single-Vendor and Multi-Vendor Support

- Web + Mobile Integration

- Modern eCommerce Essentials

- Customizable and Scalable

- Limited Customization and Scalability on Existing Platforms

- Lack of Tools for Vendors

Project Objective

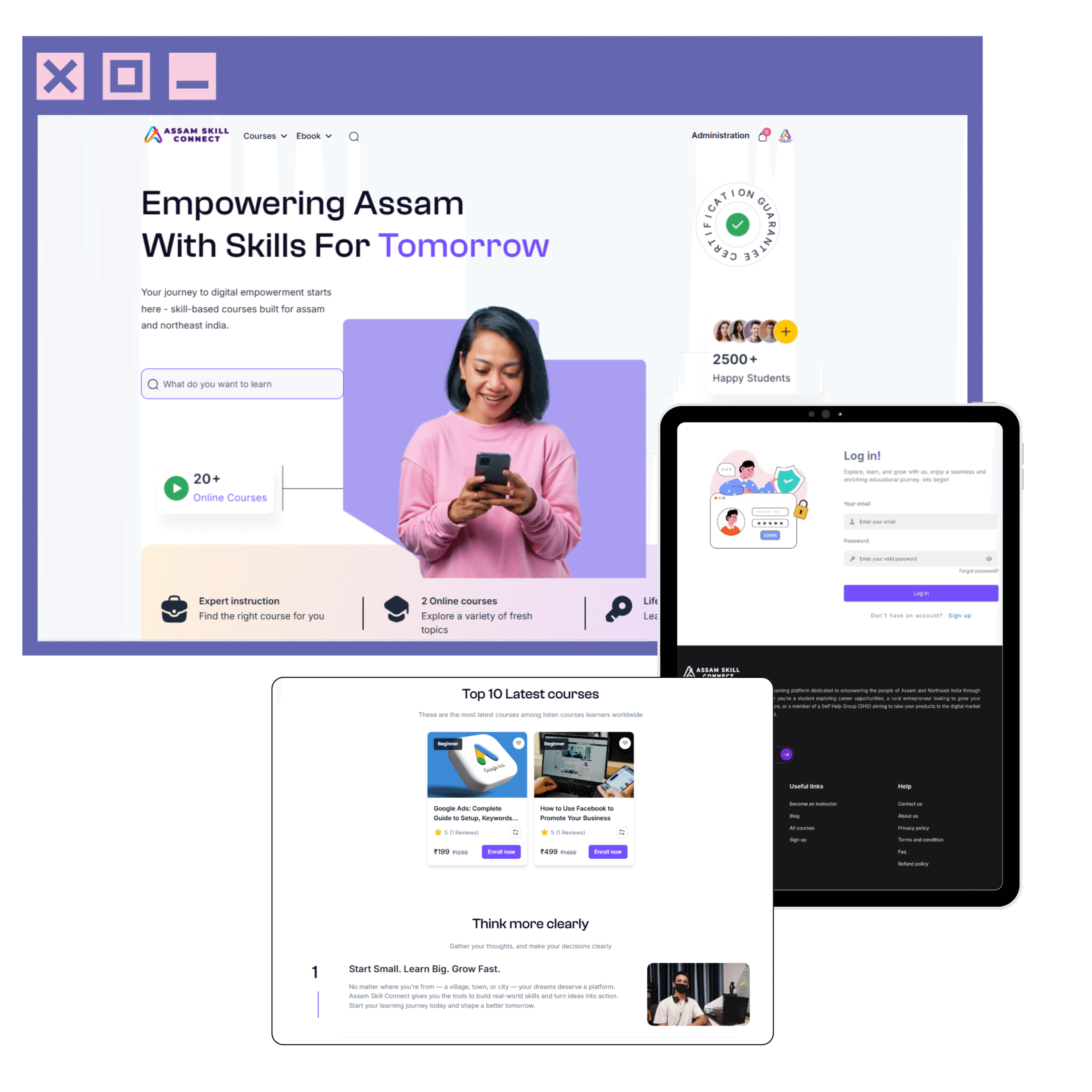

We developed a robust and scalable eCommerce platform that delivers end-to-end solutions for businesses of all sizes—ranging from individual retailers to full-fledged multi-vendor marketplaces. The platform includes both website and mobile applications (Android & iOS), offering a consistent and modern user experience across devices.

- 100% Customizable – No more one-size-fits-all limitations.

Vendor-Centric Features – Dashboards, analytics, and easy onboarding.

Fast Go-To-Market – Ready-to-deploy with modular architecture.

Unified Experience – Pixel-perfect design and real-time sync across devices.

Ideal for Local Businesses – Built with SMEs and local entrepreneurs in mind.

Scalable Architecture – Easily supports expansion from 1 to 1000+ vendors.

Take full control over their brand and digital identity

Scale effortlessly from a single store to a full marketplace

Excited to try your journey with UJU Ecosystem?

Schedule a demo today and discover new possibilities with UJU Ecosystem

Enjoy The Best Experience with Us

At Ujudebug, we don’t just build apps—we craft seamless digital experiences designed to make life easier, smarter, and more connected. Whether you’re an individual, a growing business, or a bold startup, Ujudebug delivers cutting-edge solutions backed by a deep understanding of local needs—especially in regions like Assam and Northeast India.

FAQ

Find Out Answers Here

To streamline operations like inventory, orders, payments, and customer management—all in one place.

It automates daily tasks, reduces manual errors, and provides real-time data for smarter decision-making.

Yes, a good system supports both single- and multi-vendor setups, featuring separate dashboards and controls.

Absolutely. A scalable system grows with your business, adding new products, vendors, or features easily.

It helps local stores go digital quickly, reach more customers, and compete with larger brands.

FAQ

India E-Commerce Market Trend

The Indian e-commerce market is projected to reach USD 327.38 billion by 2030, advancing at a 19.13% CAGR from USD 136.43 billion in 2025. The current growth momentum is anchored in ubiquitous mobile connectivity, a maturing digital payments infrastructure, and supportive policy measures that collectively expand online retail beyond metropolitan corridors into lower-tier cities. Consumers in tier-2 and tier-3 urban centres already account for 60% of new online shoppers, signalling a structural rebalancing of demand away from traditional retail hubs. Unified Payments Interface (UPI) transactions surpassed 208 billion in FY 2024, lowering transaction frictions and embedding real-time payments deep inside the Indian e-commerce market. Quick-commerce, live-stream shopping, and the ongoing direct-to-consumer (D2C) funding wave diversify fulfilment models and sustain shopper engagement, while macro programmes such as Digital India target a USD 1 trillion digital economy that will funnel additional traffic into the Indian e-commerce market.

Real-time payments have reset online purchase behaviour in non-metropolitan India, where digital transactions now comprise 65% of orders, materially shrinking cash-on-delivery reliance. UPI’s integration with Aadhaar authentication lowers onboarding friction for the unbanked and extends the India e-commerce market’s addressable base by a projected 150-200 million shoppers. Credit-on-UPI functionality further embeds financial flexibility directly within checkout flows, trimming platform working-capital cycles and encouraging basket expansion. Smartphones exceeding 400 million and data tariffs below USD 1 per GB underpin adoption, resulting in non-metro digital payment uptake that is four to five times faster than in tier-1 cities. Platform monetisation widens through value-added remittances and micro-lending, sustaining positive feedback loops that reinforce digital commerce penetration.

Quick-commerce platforms are on track to surpass USD 6 billion in GMV by FY 2025, growing 75-85% annually. Delivery promises under 30 minutes reset consumer expectations and lift average order values to INR 635 (USD 7.6) as assortments expand beyond groceries. More than 1,500 micro-fulfilment dark stores operate within 3 km catchments across India’s top 20 cities. Traditional e-commerce incumbents have responded with accelerated grocery roll-outs and experimental rapid-delivery pilots, reinforcing the India e-commerce market’s pivot towards immediacy.

Smartphones generated 78.06% of 2024 transactions, confirming mobile as the principal gateway into the India e-commerce market. Desktops retain relevance for high-ticket electronics and B2B research yet their share is structurally capped by ubiquitous handheld access. Voice-assisted reordering through smart speakers now appears on grocery and household staples checkouts, signalling an impending shift to ambient commerce.

AR-enabled try-ons cut fashion and beauty return rates by 40%, while 5G connectivity allows high-definition product demos in real time. Smart-TV integration brings one-click purchasing during entertainment streaming, especially for large appliances. Wearables and IoT sensors extend contextual commerce, where replenishment triggers auto-purchase before stock-outs. These nascent channels, growing at 26.53% CAGR, diversify customer touchpoints and distribute India e-commerce market exposure across everyday devices.

[/one_third][two_third]With a team of skilled software Developers, Ujudebug is the best IT Solution Company in Assam. Fully Customized Software Development services with multiple platforms. Our award winning team will we provide the best experience to customers at an affordable price.

[/one_third][two_third]With a team of skilled software Developers, Ujudebug is the best IT Solution Company in Assam. Fully Customized Software Development services with multiple platforms. Our award winning team will we provide the best experience to customers at an affordable price.